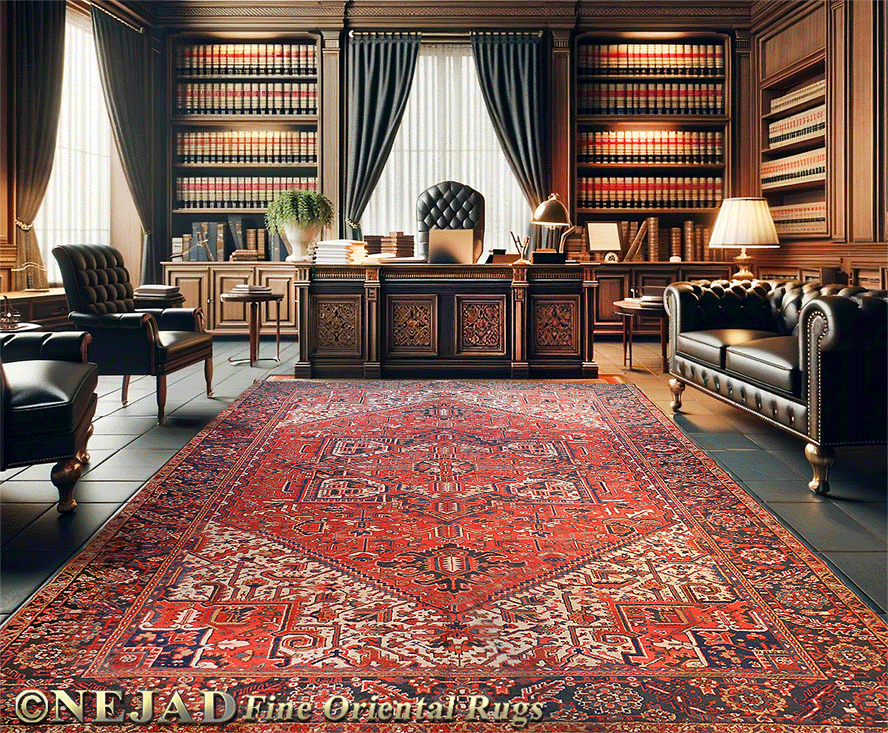

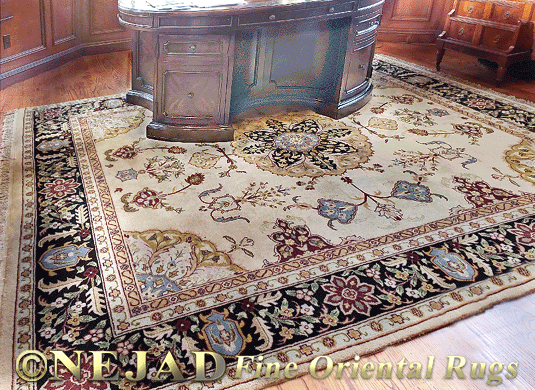

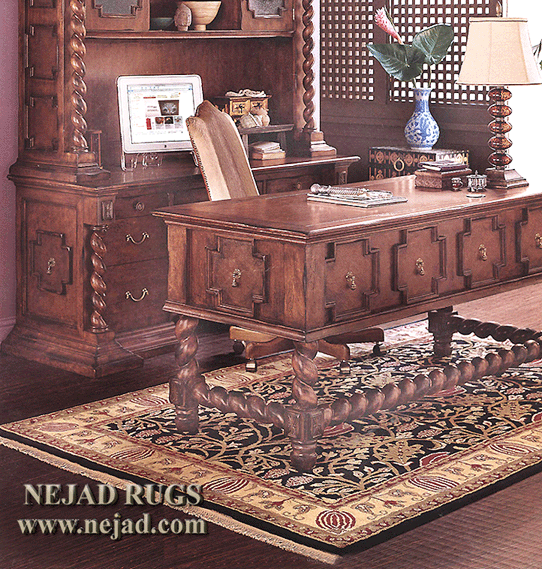

HOME OFFICE DECORATING IDEAS

Enhancing Your Home Office Space with Oriental Rugs

Conducting business following the pandemic -

as an enterpreneur or as an employee - may include adapting to the trend of working from home.

And creating a comfortable, productive office environment with oriental rugs and furniture

for a dedicated workspace in the house or apartment is certainly a good place to start. Balance

between compartmentalizing and integrating your business home office space with your living

space while adding comfort as well with unique oriental rugs and furniture for an inspiring

and vibrant dedicated work environment. Shop Nejad first - for quality, selection and price

Nejad Rugs is the industry leader for over 40 years!

Looking for the perfect desk - or desk and chair combination to complement the style, color. size and shape of your new or existing area rug? Consider and choose from today's impressive range of office furniture styles - from the traditional, featuring warm, rich tones and wood, to the transitional and eclectic to the modern and minimalistic. Make a design statement - or understatement - while insuring function and comfort. Do check out some of today's top office furniture companies such as Herman Miller, Stealcase, Haworth, HNI Knoll Inc, Global Furniture Group, Kimball and Humanscale.

It’s Not Too Late to Take Advantage of Your Professional or Home Office 2023 Tax Deductions

Whether your office is in a large corporate building or you use part of your home exclusively

and regularly for conducting business, you may be eligible to deduct expenses. The IRS allows

for tax deductions for office furniture, art and rugs and purchasing a beautiful Nejad Oriental

Rug for your office may qualify for tax deduction savings.

We already know that a beautifully designed workspace significantly boosts productivity,

motivation, and overall well-being. Such environments are often aesthetically pleasing

and ergonomically sound, reducing physical strain and mental stress. Comfortable furniture

with a beautiful Nejad Persian rug in a harmonious color scheme can uplift mood, enhance

focus, and foster creativity. With this year’s Section 179 allowed tax deduction, you can

create a nurturing setting that not only improves work efficiency but also encourages a

healthier work-life balance, contributing to greater job

satisfaction and overall happiness.

The Section 179 Deduction:

The Section 179 deduction allows businesses to write off the entire cost

of qualifying assets in the year they are purchased rather than depreciating them over time. For 2023,

the maximum Section 179 deduction is $1,160,000. Office furniture is explicitly mentioned as a

deductible expense under this section. This suggests that if office furniture, including rugs,

qualifies as a business asset, it can potentially be deducted under this rule.

Business Use of Home:

If you use part of your home exclusively and regularly for conducting business,

you may deduct expenses related to this business use. The area designated for the home

office must be exclusively used for conducting business on a regular basis. This means

the space should not be used for personal activities.

Your home office must be the principal place of your business, or a place where you

regularly meet with clients or patients. This rule has some flexibility; for example,

if you conduct business at a location outside of your home but use your home substantially

and regularly to conduct business, you may qualify for a home office deduction.

If the space is a separate structure not attached to your home, it does not have to be

your principal place of business, as long as it's used exclusively and regularly for your

business.

These expenses can include mortgage interest, insurance, utilities, repairs, and

depreciation. In this context, if an office rug is used exclusively and regularly in a part

of your home devoted to business, it may be considered for a deduction. However, the specific

inclusion of rugs isn't explicitly detailed in the IRS guidelines.

Ordinary and Necessary Business Expenses: The IRS guidelines state that business expenses must be both ordinary and necessary to qualify for tax deductions. Ordinary expenses are those that are common and accepted in your trade or business. Necessary expenses are those that are helpful and appropriate for running the business. If office rugs are deemed ordinary and necessary for your business operations, they may qualify as deductible expenses.

In summary, office furniture, including rugs, may be tax-deductible if they are considered necessary and

ordinary business expenses, and if they are used exclusively and regularly in a part of your home

dedicated to business. The Section 179 deduction offers a pathway for immediate write-offs of such assets.

As tax laws can be complex and subject to interpretation, it's advisable to consult with a tax professional

or an accountant to assess the specific circumstances of your business and ensure compliance with IRS rules.

As tax laws can change and individual circumstances vary, it's always highly recommended to consult with a

tax professional for advice specific to your situation.

Previous Page | Nejad Home | Contact Us

Nejad Rugs • 1 N Main St • Doylestown, PA • 215-348-1255