Whether your office is in a large corporate building or you use part of your home

exclusively and regularly for conducting business, you may be eligible to deduct

expenses. The IRS allows for tax deductions for office furniture, art and rugs and

purchasing a beautiful Nejad Oriental Rug for your office may qualify for tax

deduction savings.

We already know that a beautifully designed workspace significantly boosts productivity,

motivation, and overall well-being. Such environments are often aesthetically pleasing

and ergonomically sound, reducing physical strain and mental stress. Comfortable

furniture with a beautiful Nejad Persian rug in a harmonious color scheme can uplift

mood, enhance focus, and foster creativity. With this year’s Section 179 allowed tax

deduction, you can create a nurturing setting that not only improves work efficiency but

also encourages a healthier work-life balance, contributing to greater job satisfaction

and overall happiness.

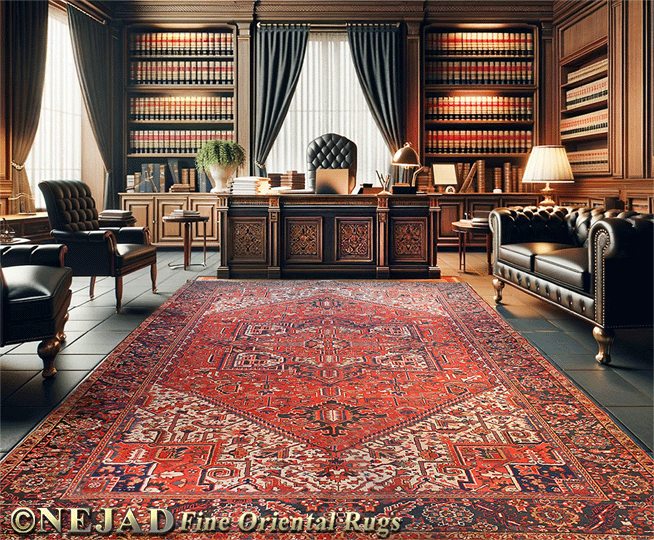

These professional offices feature Nejad Oriental Rugs, from light colors to rich jewel

tones in varying classic and transitional patterns.

The Section 179 Deduction: The Section 179 deduction allows businesses to write off

the entire cost of qualifying assets in the year they are purchased rather than

depreciating them over time. For 2023, the maximum Section 179 deduction is

$1,160,000. Office furniture is explicitly mentioned as a deductible expense under

this section. This suggests that if office furniture, including rugs, qualifies as

a business asset, it can potentially be deducted under this rule.

Business Use of Home: If you use part of your home exclusively and regularly for

conducting business, you may deduct expenses related to this business use. The area

designated for the home office must be exclusively used for conducting business on

a regular basis. This means the space should not be used for personal activities.

Your home office must be the principal place of your business, or a place where

you regularly meet with clients or patients. This rule has some flexibility; for

example, if you conduct business at a location outside of your home but use your

home substantially and regularly to conduct business, you may qualify for a home

office deduction.

If the space is a separate structure not attached to your home, it does not have

to be your principal place of business, as long as it’s used exclusively and

regularly for your business.

These expenses can include mortgage interest, insurance, utilities, repairs,

and depreciation. In this context, if an office rug is used exclusively and

regularly in a part of your home devoted to business, it may be considered

for a deduction. However, the specific inclusion of rugs isn’t explicitly

detailed in the IRS guidelines.

Ordinary and Necessary Business Expenses: The IRS guidelines state that

business expenses must be both ordinary and necessary to qualify for tax

deductions. Ordinary expenses are those that are common and accepted in your

trade or business. Necessary expenses are those that are helpful and

appropriate for running the business. If office rugs are deemed ordinary

and necessary for your business operations, they may qualify as deductible

expenses.

In summary, office furniture, including rugs, may be tax-deductible if they

are considered necessary and ordinary business expenses, and if they are used

exclusively and regularly in a part of your home dedicated to business. The

Section 179 deduction offers a pathway for immediate write-offs of such assets.

As tax laws can be complex and subject to interpretation, it’s advisable to

consult with a tax professional or an accountant to assess the specific

circumstances of your business and ensure compliance with IRS rules.

As tax laws can change and individual circumstances vary, it’s always highly

recommended to consult with a tax professional for advice specific to your

situation.